Inventory markets dropped in Europe and Asia following a slide on Wall Avenue, with know-how shares sustaining a recent blow from issues that rising inflation will immediate central banks to tighten financial coverage.

Europe’s Stoxx 600 index dropped 2 per cent in morning dealings, with markets in Germany and France down by an identical margin. London’s FTSE 100 fell by 2.3 per cent. The falls got here after America’s technology-heavy Nasdaq Composite declined 2.6 per cent on Monday.

Expertise shares endured the heaviest promoting in Europe on Tuesday, with the Stoxx 600 tech index sliding 2.3 per cent decrease. Each different main business group was additionally decrease on the day, in line with Refinitiv information.

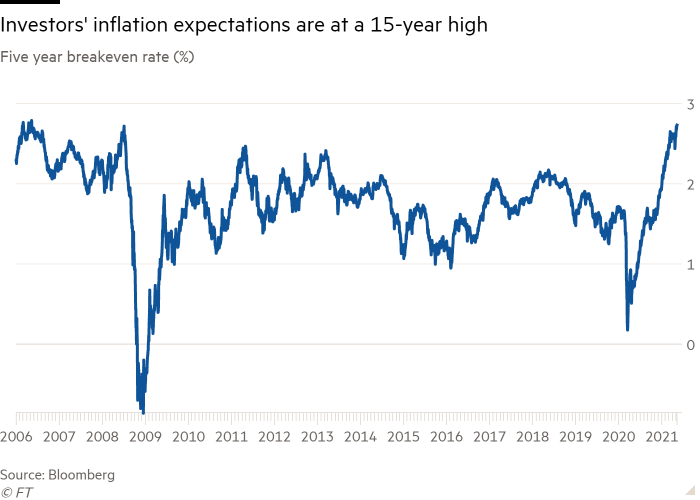

Markets are on edge forward of latest inflation information out of the US on Wednesday, which traders fear is operating sizzling — doubtlessly forcing the Federal Reserve to rein in its extremely supportive financial insurance policies regardless of assurances from policymakers that they’re prepared to tolerate quick bursts of upper costs with the intention to help the financial restoration.

The information are anticipated to indicate client costs rose by 3.6 per cent in April in contrast with the identical time final 12 months, and 0.2 per cent in contrast with March 2021. A “core” index that excludes risky meals and vitality costs is forecast to rise 0.3 per cent from the earlier month. Citigroup economists anticipate rising used automotive, transportation and lodge costs to push up the core index.

Information on Tuesday confirmed that Chinese language manufacturing unit gate costs, an indicator of what home shoppers and western importers pays for items, rose to a three-year excessive of 6.8 per cent final month, 12 months on 12 months.

Hong Kong’s Cling Seng closed greater than 2 per cent decrease and Japan’s Nikkei 225 ended the Tokyo buying and selling session down greater than 3 per cent.

Inflation not solely raises the probabilities of central banks withdrawing help for markets. It additionally erodes the returns on fixed-income securities comparable to authorities bonds, inflicting their costs to fall and yields to rise. The yield on the US Treasury bond informs how traders worth the long run money flows from equities. Analysts say it is a significantly necessary issue for tech shares, which have risen quickly in the course of the pandemic and have had their valuations flattered by low rates of interest.

Shares in lots of Wall Avenue excessive flyers have begun to tug again sharply. Cathie Wooden’s Ark fund, which holds shares in corporations comparable to Tesla, is down about a third from its February peak, whereas different frothy elements of the market like unprofitable tech corporations and teams uncovered to fluctuations within the worth of bitcoin have stumbled.

Jay Powell, chair of the US Federal Reserve, has pledged to proceed the central financial institution’s $120bn of month-to-month bond purchases which have boosted markets by way of the pandemic till the trail of restoration turns into clearer.

“We anticipate the speedy financial restoration this 12 months, and resultant pick-up in inflationary pressures, will immediate traders to more and more consider a tighter actual stance of financial coverage additional down the road,” analysts at Capital Economics commented in a analysis observe.

The yield on the benchmark 10-year US Treasury added 0.01 of a proportion level to 1.615 per cent on Tuesday and has climbed from about 0.9 per cent at the beginning of the 12 months.

Not all analysts are bearish concerning the future route of equities, with some sustaining that increased inflation within the US will show transient as client demand stabilises and provide chain bottlenecks associated to business shutdowns final 12 months are solved.

“Whereas traders have been worrying about inflation recently, we anticipate any near-term spike in inflation to be momentary and never involved with persistent inflation,” stated Andrea Bevis, senior vice-president at UBS non-public wealth administration.

She added, nonetheless, that “traders ought to diversify past mega-cap tech corporations and rotate into cyclical and value-oriented areas of the market”, comparable to vitality producers and industrial teams, “that ought to proceed to learn from increased yields and a broadening financial restoration”.

#techAsia — Weekly e-newsletter

Your essential information to the billions being made and misplaced on this planet of Asia Tech. A curated menu of unique information, crisp evaluation, sensible information and the newest tech buzz from the FT and Nikkei